In the world of investing, particularly in the realm of angel investing, market volatility is a phenomenon that can significantly impact the decision-making process of investors. The unpredictability of market fluctuations can make it challenging to navigate the investment landscape, leading to potential risks and uncertainties. However, with the right strategies and precautions in place, angel investors can safeguard their investments and mitigate the effects of market volatility.

Understanding Market Volatility

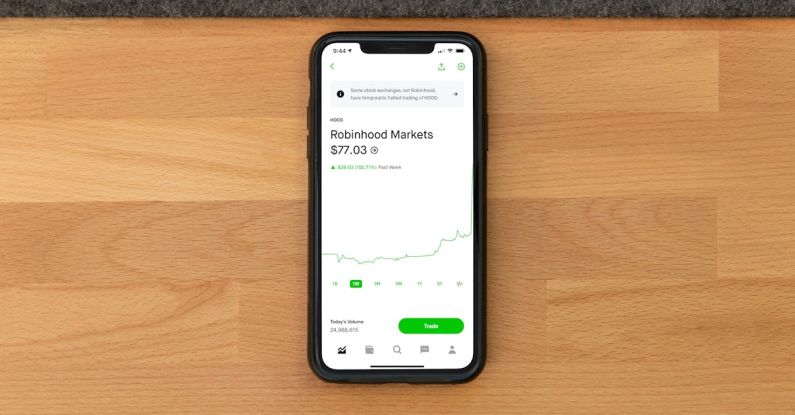

Market volatility refers to the rate at which the price of a security or market index fluctuates over a period of time. It is a measure of the degree of variation in the trading price of an asset, indicating the level of risk and uncertainty in the market. Factors such as economic events, geopolitical tensions, interest rates, and investor sentiment can all contribute to market volatility, causing prices to fluctuate rapidly and unexpectedly.

Diversification Is Key

One of the most effective strategies for mitigating the impact of market volatility on angel investments is diversification. Diversifying your investment portfolio across different industries, sectors, and stages of development can help spread risk and minimize the potential negative effects of market fluctuations. By spreading your investments across a range of opportunities, you can reduce the impact of a downturn in any single investment on your overall portfolio.

Due Diligence and Research

In a volatile market environment, conducting thorough due diligence and research before making investment decisions is crucial. By carefully analyzing the financials, market potential, and management team of a startup, angel investors can make more informed investment choices and reduce the risk of losses due to market volatility. Taking the time to understand the underlying fundamentals of a company can help investors identify opportunities with strong growth potential and resilience in the face of market turbulence.

Stay Informed and Adapt

Staying informed about market trends, economic indicators, and geopolitical developments is essential for angel investors looking to navigate market volatility successfully. By keeping abreast of relevant news and information, investors can better anticipate market movements and adjust their investment strategies accordingly. Being proactive and adaptive in response to changing market conditions can help investors capitalize on opportunities and minimize potential losses during periods of volatility.

Risk Management and Contingency Planning

In a volatile market environment, risk management and contingency planning are critical aspects of safeguarding angel investments. Establishing clear risk management protocols, setting investment limits, and defining exit strategies can help investors protect their capital and minimize losses in the event of market downturns. By setting realistic expectations, having a diversified portfolio, and being prepared for various market scenarios, investors can better position themselves to weather the storms of market volatility.

Maintaining a Long-Term Perspective

While market volatility can create short-term fluctuations and uncertainties, maintaining a long-term perspective is essential for angel investors looking to achieve sustainable returns on their investments. By focusing on the underlying value and growth potential of their investments, rather than being swayed by short-term market fluctuations, investors can make more informed decisions that align with their long-term financial goals. Keeping a cool head and avoiding knee-jerk reactions to market volatility can help investors stay focused on their investment objectives and avoid making hasty decisions that could impact their returns in the long run.

Conclusion: Safeguarding Your Angel Investments

In conclusion, angel investing in a volatile market requires a combination of strategic planning, risk management, and adaptability. By diversifying your portfolio, conducting thorough research, staying informed, and maintaining a long-term perspective, angel investors can navigate market volatility with greater confidence and resilience. While market fluctuations are inevitable, taking proactive steps to safeguard your investments and mitigate risks can help you weather the storms of uncertainty and position yourself for long-term success in the world of angel investing.